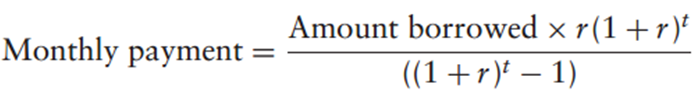

Monthly Payment Formula for paying installment loan

When we take out an installment loan, the amount of the payment depends on three things: the amount of money we borrow (sometimes called the principal), the interest rate (or APR), and the term of the loan. Calculate the monthly payment formula in real time.

Here, t is the term in months and r = APR/12 is the monthly interest rate as a decimal.

Vary the amount of money borrowed and the annual percentage rate to see your monthly payments changing.

Scroll the Term slider to follow the

corresponding payment period.

| Amount borrowed | APR | Term | Monthly Payment $1,569.61 |

| $15,000 | 10% | 10 |

0,0

1

2

3

4

5

6

7

8

9

10

| Months | Interest | Principal | Remaining balance |

| 1 | $125.00 | $1,444.61 | $13,555.39 |

| 2 | $112.96 | $1,456.64 | $12,098.75 |

| 3 | $100.82 | $1,468.78 | $10,629.97 |

| 4 | $88.58 | $1,481.02 | $9,148.94 |

| 5 | $76.24 | $1,493.36 | $7,655.58 |

| 6 | $63.80 | $1,505.81 | $6,149.77 |

| 7 | $51.25 | $1,518.36 | $4,631.41 |

| 8 | $38.60 | $1,531.01 | $3,100.40 |

| 9 | $25.84 | $1,543.77 | $1,556.63 |

| 10 | $12.97 | $1,556.63 | $0.00 |

| Total: $696.06 | Total: $15,000.00 |

Questions

1. What is the total amount of money that you would have to pay on a loan of $10,000 at 7.5% interest over 15 years?

2. As time passes, does the amount of your payment that goes towards interest increase or decrease?

3. As time passes, does the amount of your payment that goes towards principal increase or decrease?

4. If you borrow $7,500 what slider values would be necessary to pay less than $2000 in interest over the life of the loan?

2. As time passes, does the amount of your payment that goes towards interest increase or decrease?

3. As time passes, does the amount of your payment that goes towards principal increase or decrease?

4. If you borrow $7,500 what slider values would be necessary to pay less than $2000 in interest over the life of the loan?